All Activity

- Today

-

Hajdaros joined the community

- Yesterday

-

Violetta74Na started following BCGame_Maxim

-

Violetta74Na joined the community

-

joserivera12219 started following Sszbhhjcdycc

-

joserivera12219 joined the community

-

13 sec ago - Get Free Xbox Gift Cards, with Just a Few Clicks! CLICK HERE TO GET FREE CLICK HERE TO GET FREE What Are Xbox wallet Gift Card Codes? Xbox wallet gift card codes are alphanumeric strings that represent a specific monetary value. Users can redeem these codes on the Xbox wallet to add funds to their account. These codes are region-specific and come in various denominations, such as $10, $20, $35, $50, or even custom values in promotional scenarios. Why People Seek Unused Xbox wallet Codes Many users seek free or unused Xbox wallet gift card codes for various reasons: Cost Savings The rising cost of digital games can strain budgets. Free or promotional codes allow users to access premium content without spending real money. Gifting Unused codes make for great digital gifts. Since they are not tied to a specific account, the receiver can easily redeem them. Instant Gratification Unlike physical cards that require a trip to a store, digital codes offer instant delivery, especially when obtained from online giveaways or promotions. Contests and Promotions Gamers often participate in online contests or surveys promising free Xbox wallet codes. These can be legitimate or scams, making it important to know reliable sources. How to Obtain Free Xbox wallet Gift Card Codes Participate in Official Promotions Xbox occasionally runs official promotions where users can earn points and exchange them for wallet credits. Rewards Websites Some websites reward users with points for completing surveys, watching videos, or walletping online. These points can be redeemed for wallet codes. Always ensure the platform is legitimate and has positive reviews. Giveaways on Social Media Influencers and content creators sometimes host giveaways, offering wallet gift card codes to followers who like, share, and comment. Gaming Forums and Communities Subreddits, Discord servers, and other gaming communities occasionally share promo codes. Engage with communities like r/XboxSwitch for potential opportunities. Mobile Apps Apps like Google Opinion Rewards offer credits that can be used to buy Xbox wallet gift cards on platforms like the Google Play Store or Amazon. How to Redeem Xbox wallet Gift Card Codes On Xbox Switch: Go to the Xbox wallet from the Home screen. Select the account you want to use. Scroll down and select "Enter Code." Enter the 16-character code. Click "OK" to confirm. Funds will be added to your balance. On the Xbox Website: Visit the Xbox official website. Sign in with your Xbox account. Go to "Redeem Code." Input the 16-character code. The funds will reflect in your account balance. Security Tips for Using Xbox wallet Gift Cards Beware of Scams Sites offering “unlimited free wallet codes” with no effort are often fraudulent. Stick to well-reviewed and secure platforms. Don’t Share Codes Publicly Once a code is used, it's no longer valid. Sharing it publicly can result in someone else redeeming it first. Use Two-Factor Authentication Protect your Xbox account with two-factor authentication to prevent unauthorized purchases. Check the Source Only purchase or obtain codes from verified sources such as Xbox, Amazon, Best Buy, or known partners. The Value of Unused wallet Codes in the Gaming Economy Unused codes retain full monetary value and are considered digital currency in the Xbox ecosystem. They can be traded, gifted, or sold in some cases (though resale is against Xbox's terms). Their digital nature makes them valuable assets, especially during sales and special promotions. Pros and Cons of Using Xbox wallet Gift Card Codes Pros: Convenient and easy to use Can be used for gifting Supports budgeting Instant delivery (digital versions) No need to store payment details Cons: Risk of scams online Region-specific Can be lost if not redeemed in time Common Denominations and Where to Buy Popular Denominations: $10 $20 $35 $50 Custom values in promotional scenarios Retailers: Xbox.com Amazon Best Buy Walmart Target GameStop Reference Information Xbox Official Support Pages Reddit Communities (e.g., r/XboxSwitchDeals) Gaming News Sites like IGN, Polygon Influencer social media posts (e.g., Twitter, Instagram) Consumer Reviews on Trustpilot Frequently Asked Questions Are free Xbox wallet gift card codes legit? Some are, especially through promotions or rewards programs, but beware of scams. Can I use a gift card from another region? No, wallet cards are region-locked. You need a card that matches your account region. Do wallet gift cards expire? Generally, no. But it's best to use them within a reasonable time frame. Can I combine multiple gift cards? Yes, funds from multiple cards can be added to your account. What if I entered the wrong code? Double-check the code. If it still doesn’t work, contact Xbox support. Are there taxes on wallet purchases? Yes, sales tax may apply depending on your location. What can I buy with an wallet card? Games, DLCs, apps, in-game items, and subscriptions. Can I gift a digital wallet card? Yes, many retailers allow you to send digital cards via email. Is there a way to check the balance of a gift card? No, the balance is only known after redeeming it to your account. What should I do if my card is stolen or lost? If it hasn't been redeemed, contact the retailer where you purchased it. Related Keywords (50) free Xbox wallet codes unused Xbox wallet gift cards how to get Xbox wallet codes redeem wallet code Xbox wallet balance digital gift cards for switch Xbox game codes wallet card code generator safe wallet code sites how to earn Xbox points buy Xbox wallet gift card wallet gift card online Xbox switch gift code free switch game credit Xbox rewards program instant Xbox gift card legit wallet code websites redeem switch gift card top wallet gift card hacks daily free Xbox codes Xbox e gift cards wallet credit fast 16-digit wallet code free wallet credit 2025 earn wallet points survey switch code giveaways wallet code no human verification free game codes switch Xbox e card wallet code trick buy wallet card paypal switch wallet promo code unclaimed wallet codes Xbox wallet card legit wallet code instant email redeem wallet funds how to send wallet gift best wallet deals Xbox switch prepaid code wallet account balance check wallet wallet top up switch prepaid gift Xbox code scanner earn gift card Xbox switch wallet tips wallet code mobile wallet rewards app get wallet code from receipt cheap Xbox wallet codes limited-time Xbox deals

-

KevinUSA joined the community

-

Today get Free Energy for Travel Town: Instant Updates and Tips for Unused Energy Welcome to your ultimate guide on free energy in Travel Town—your go-to source for mastering energy usage, discovering hidden hacks, and gaining the upper hand without spending real money. CLICK HERE GET FREE ENERGY CLICK HERE GET FREE ENERGY Whether you’re a new player or a seasoned one looking to optimize your gameplay, this article has you covered. Understanding Energy in Travel Town Energy in Travel Town is your primary resource to merge, level up, and unlock valuable items. It's what keeps the town alive and thriving. What is Energy Used For? Energy is consumed when: Merging objects Unlocking chests Completing delivery tasks Interacting with specific buildings Why Free Energy Matters Spending real money for energy isn’t sustainable for most players. That’s why free energy hacks are in high demand. Mastering free energy sources means: Faster progress Smarter inventory management Higher player satisfaction Instant Free Energy Methods Explore multiple instant energy recovery tactics to keep the game moving without delay. Watch Ads for Quick Energy Boosts One of the most efficient ways is watching short in-game video ads. Each ad usually grants: 15–30 units of energy Can be repeated up to 5–7 times daily Use Daily Login Bonuses The daily reward system often includes energy refills: Login streaks unlock more generous packages Set reminders to never miss a bonus Level Up to Refill Energy Every time you level up, your energy bar gets a full recharge. Focus on completing quests Merge high-value items to earn XP quickly Energy from Delivery Trucks Fulfilling delivery tasks can yield free energy and other resources. Prioritize: Requests with energy symbols Timed deliveries for faster replenishment Unused Energy Recovery Tips Unused energy often gets wasted if not managed wisely. Here's how to avoid that. Don’t Let Energy Max Out When your energy bar is full, no more is generated. Use it before: Going offline Watching energy ads Activating boosters Convert Unused Energy into Progress Use your idle energy before bedtime to: Complete easy merge cycles Stock up on valuable merge chains Best Time to Use Energy in Travel Town Using energy at optimal times improves overall resource efficiency. Use Energy During Events Special events offer: Double XP Bonus energy for tasks Free chests that may include energy Morning and Evening Sessions Divide gameplay into two major sessions to maximize energy regeneration overnight and throughout the day. Advanced Energy Generation Tricks Some lesser-known techniques can keep your gameplay fluid and uninterrupted. Energy from Friend Gifts Connect with other players and: Send/receive energy daily Use energy exchange circles to stay topped up Join Travel Town Communities Being in active groups helps uncover: Hidden in-game codes Energy giveaways Strategy tips from top players Use Merge Trees Efficiently Merge trees consume energy. Use only: High-reward tree branches Trees linked to quests or events Hints for Long-Term Energy Management Mastering energy management long-term means steady progress and resource control. Avoid Over-Merging Unnecessary merges drain energy. Be strategic: Merge only what's needed Save resources for delivery chains Optimize Generator Placement Place energy generators in easily accessible sections of the board to: Minimize movement Speed up merging cycles Use Energy Wisely During Item Cooldown Plan merges when items are recharging. This saves: Energy waste Time lost waiting Unused Tips Most Players Ignore Here are some lesser-known but effective tactics: Turn on Notifications for Energy Alerts Many players miss refill notices. Turn on: Push notifications Email updates from the game Sync with Cloud to Avoid Data Loss Ensure your energy progress is saved by syncing your game with: Google Play Games Apple Game Center Avoiding Energy Traps Some in-game activities seem useful but are energy traps in disguise. Don’t Always Open Every Chest Chests cost energy and space. Open only: Quest-related chests Timed reward chests Limit Side Quest Engagement Side quests may appear appealing but can drain energy quickly with minimal reward. Prioritize: Main quests Community events Saving Time and Energy with Boosters Boosters enhance energy regeneration. Use them strategically. Use 2x Speed Merges During Peak Energy Activate this when: Energy bar is full You have a merging plan in place Common Mistakes That Waste Energy Learn from others’ mistakes to improve your own strategy. Rushing Merge Chains Over-merging with low-level items wastes: Time Energy Inventory space Ignoring Event Timers Event resets can rob you of unclaimed rewards. Watch: Countdown clocks Reward cycles FAQ: Free Energy for Travel Town Q1: How do I get free energy fast in Travel Town? You can get free energy by watching ads, completing deliveries, and logging in daily. Level-ups and gift exchanges also help. Q2: What is the best way to use free energy in the game? Use energy during events or when you have a clear merging strategy to gain maximum XP and rewards. Q3: Can I save unused energy for later? Energy regenerates over time and has a cap. Use it before it maxes out to avoid waste. Q4: Are energy boosters worth it? Yes, especially during merge-heavy events or delivery rushes. They amplify progress and help conserve time. Q5: Can I get energy from friends? Yes, adding friends and sending daily gifts is a reliable way to earn free energy regularly.

-

Today get Free Energy for Travel Town: Instant Updates and Tips for Unused Energy Welcome to your ultimate guide on free energy in Travel Town—your go-to source for mastering energy usage, discovering hidden hacks, and gaining the upper hand without spending real money. CLICK HERE GET FREE ENERGY CLICK HERE GET FREE ENERGY Whether you’re a new player or a seasoned one looking to optimize your gameplay, this article has you covered. Understanding Energy in Travel Town Energy in Travel Town is your primary resource to merge, level up, and unlock valuable items. It's what keeps the town alive and thriving. What is Energy Used For? Energy is consumed when: Merging objects Unlocking chests Completing delivery tasks Interacting with specific buildings Why Free Energy Matters Spending real money for energy isn’t sustainable for most players. That’s why free energy hacks are in high demand. Mastering free energy sources means: Faster progress Smarter inventory management Higher player satisfaction Instant Free Energy Methods Explore multiple instant energy recovery tactics to keep the game moving without delay. Watch Ads for Quick Energy Boosts One of the most efficient ways is watching short in-game video ads. Each ad usually grants: 15–30 units of energy Can be repeated up to 5–7 times daily Use Daily Login Bonuses The daily reward system often includes energy refills: Login streaks unlock more generous packages Set reminders to never miss a bonus Level Up to Refill Energy Every time you level up, your energy bar gets a full recharge. Focus on completing quests Merge high-value items to earn XP quickly Energy from Delivery Trucks Fulfilling delivery tasks can yield free energy and other resources. Prioritize: Requests with energy symbols Timed deliveries for faster replenishment Unused Energy Recovery Tips Unused energy often gets wasted if not managed wisely. Here's how to avoid that. Don’t Let Energy Max Out When your energy bar is full, no more is generated. Use it before: Going offline Watching energy ads Activating boosters Convert Unused Energy into Progress Use your idle energy before bedtime to: Complete easy merge cycles Stock up on valuable merge chains Best Time to Use Energy in Travel Town Using energy at optimal times improves overall resource efficiency. Use Energy During Events Special events offer: Double XP Bonus energy for tasks Free chests that may include energy Morning and Evening Sessions Divide gameplay into two major sessions to maximize energy regeneration overnight and throughout the day. Advanced Energy Generation Tricks Some lesser-known techniques can keep your gameplay fluid and uninterrupted. Energy from Friend Gifts Connect with other players and: Send/receive energy daily Use energy exchange circles to stay topped up Join Travel Town Communities Being in active groups helps uncover: Hidden in-game codes Energy giveaways Strategy tips from top players Use Merge Trees Efficiently Merge trees consume energy. Use only: High-reward tree branches Trees linked to quests or events Hints for Long-Term Energy Management Mastering energy management long-term means steady progress and resource control. Avoid Over-Merging Unnecessary merges drain energy. Be strategic: Merge only what's needed Save resources for delivery chains Optimize Generator Placement Place energy generators in easily accessible sections of the board to: Minimize movement Speed up merging cycles Use Energy Wisely During Item Cooldown Plan merges when items are recharging. This saves: Energy waste Time lost waiting Unused Tips Most Players Ignore Here are some lesser-known but effective tactics: Turn on Notifications for Energy Alerts Many players miss refill notices. Turn on: Push notifications Email updates from the game Sync with Cloud to Avoid Data Loss Ensure your energy progress is saved by syncing your game with: Google Play Games Apple Game Center Avoiding Energy Traps Some in-game activities seem useful but are energy traps in disguise. Don’t Always Open Every Chest Chests cost energy and space. Open only: Quest-related chests Timed reward chests Limit Side Quest Engagement Side quests may appear appealing but can drain energy quickly with minimal reward. Prioritize: Main quests Community events Saving Time and Energy with Boosters Boosters enhance energy regeneration. Use them strategically. Use 2x Speed Merges During Peak Energy Activate this when: Energy bar is full You have a merging plan in place Common Mistakes That Waste Energy Learn from others’ mistakes to improve your own strategy. Rushing Merge Chains Over-merging with low-level items wastes: Time Energy Inventory space Ignoring Event Timers Event resets can rob you of unclaimed rewards. Watch: Countdown clocks Reward cycles FAQ: Free Energy for Travel Town Q1: How do I get free energy fast in Travel Town? You can get free energy by watching ads, completing deliveries, and logging in daily. Level-ups and gift exchanges also help. Q2: What is the best way to use free energy in the game? Use energy during events or when you have a clear merging strategy to gain maximum XP and rewards. Q3: Can I save unused energy for later? Energy regenerates over time and has a cap. Use it before it maxes out to avoid waste. Q4: Are energy boosters worth it? Yes, especially during merge-heavy events or delivery rushes. They amplify progress and help conserve time. Q5: Can I get energy from friends? Yes, adding friends and sending daily gifts is a reliable way to earn free energy regularly.

-

progamer2 joined the community

-

Free TikTok Followers & Fans Profile Setup Tips 10k-1000-10000-1k (Boost Real Views, Likes) [SJPQLFT50] In the ever-evolving world of social media, TikTok has emerged as a powerhouse platform, captivating millions with its short, engaging videos. As users race to build their online presence, one question looms large: How can you gain free TikTok followers? This article delves into effective strategies to boost your TikTok audience without breaking the bank, while keeping SEO techniques in mind. CLICK HERE TO GET ACCESS ➤➤ CLICK HERE TO GET ACCESS ➤➤ Understanding the Importance of Followers on TikTok Before diving into strategies, it’s crucial to understand why followers matter. Having a solid follower count not only enhances your credibility but also increases your chances of getting featured in the "For You" page—TikTok's algorithmic showcase of popular content. More followers often lead to higher engagement rates, which can significantly impact your reach and visibility on the platform. 1. Create High-Quality Content The cornerstone of gaining free TikTok followers lies in producing compelling content. Here’s what you need to focus on: a. Authenticity Users gravitate toward authentic creators. Share your unique voice, interests, and style, as authenticity helps establish a connection with your audience. b. Trending Topics Keep an eye on current trends and challenges. By incorporating popular themes into your content, you increase your chances of being discovered by new viewers. c. High Production Quality Invest time in editing your videos. Use good lighting, crisp sound, and appealing visuals to create professional-looking content that stands out. 2. Optimize Your Profile Your TikTok profile is your online business card. An optimized profile can attract more followers. Here’s how: a. Catchy Username Choose a memorable username that reflects your brand or personality. Avoid complex spellings which can make it hard for users to find you. b. Engaging Bio Craft a bio that tells users who you are and what kind of content they can expect. Consider including keywords like "free TikTok followers" to boost discoverability. c. Profile Picture Utilize a clear and eye-catching profile picture. A friendly image or your logo can increase the likelihood of users following you. 3. Leverage Hashtags Effectively Hashtags are crucial for content visibility on TikTok. Using the right hashtags can introduce your videos to a broader audience. a. Popular Hashtags Incorporate trending hashtags relevant to your content. This not only boosts visibility but also ties your videos to current conversations. b. Niche-Specific Hashtags Don’t just rely on the popular tags; use niche-specific hashtags to connect with a targeted audience genuinely interested in your content. c. Brand Your Own Hashtag Consider creating a unique hashtag for your content, encouraging followers to engage with your videos and contribute their own takes. 4. Engage with Your Audience True engagement goes both ways. Here are ways to build relationships with your followers: a. Respond to Comments Take the time to reply to comments on your videos. Acknowledging your viewers can foster a sense of community and encourage more interactions. b. Follow Back If appropriate, follow back some of your new followers. This gesture can motivate them to remain engaged and loyal to your content. c. Use Polls and Q&A Incorporate interactive features like polls and Q&A sessions to invite direct engagement, prompting viewers to participate and share their thoughts. 5. Collaborate with Other Creators Collaboration can be a powerful tool in increasing your followers. By partnering with other TikTok users, you tap into their audience base. a. Find Your Niche Collaborate with creators who share similar interests or demographics. This ensures that the audience you reach is genuinely interested in your content. b. Cross-Promotion When you collaborate, both parties should promote the content on their profiles. This mutual endorsement can attract new followers for both creators. c. Participate in Duets Utilize the duet feature to engage with popular videos, offering your take while reaching new viewers who might be drawn to your unique style. 6. Post Consistently Consistency is key in maintaining and growing your audience. Develop a posting schedule that works for you and stick to it. a. Determine Optimal Times Identify when your audience is most active. Use TikTok's analytics tools to discover peak engagement times and plan your posts accordingly. b. Content Variety Experiment with different content types—comedy, tutorials, lifestyle, challenges, etc.—to keep your audience engaged and coming back for more. c. Set Goals Establish realistic goals for your posting frequency and follower growth. Adjust your strategy based on what works and what doesn’t. 7. Promote Your TikTok on Other Platforms Utilizing other social media platforms can drive traffic to your TikTok profile, leading to more free TikTok followers. a. Share Clips on Instagram Post short clips of your TikTok videos on Instagram Stories or Reels, encouraging your audience to follow you on TikTok for the full experience. b. Utilize YouTube Shorts Convert your TikTok videos into YouTube Shorts. This cross-promotion can expose your content to a different audience. c. Engage on Twitter Share your TikTok links on Twitter to drive traffic. Engaging with trending topics on Twitter can also attract potential followers. Conclusion: The Path to Free TikTok Followers Building a follower base on TikTok requires a blend of creativity, strategy, and authenticity. By focusing on high-quality content, optimizing your profile, effectively using hashtags, engaging with your audience, collaborating with creators, posting consistently, and promoting your TikTok on other platforms, you can significantly increase your chances of gaining free TikTok followers. Remember, the key to long-term success on TikTok is patience and authenticity. Stay true to your style, keep experimenting with content, and watch your follower count grow organically over time. With consistency and dedication, you’ll make your mark in the vibrant world of TikTok.

-

Why Gamers Love Xbox Gift Card Codes The gaming community is one of the most passionate groups in the entertainment world. From blockbuster releases to indie gems, every player wants the chance to explore new titles, unlock exclusive content, and expand their gaming library. One of the most popular ways to do this is through Xbox gift card codes. While at first glance they might seem like a simple prepaid option, for many gamers they have become something more—a symbol of convenience, accessibility, and opportunity. In this article, we’ll explore why players across the globe love Xbox gift card codes, how they use them, and the cultural significance they have within gaming circles. Claim Now - Claim Now - The Flexibility of Xbox Gift Card Codes Unlike physical discs or digital purchases tied to a specific game, Xbox gift cards provide versatility. Gamers can use them to: Purchase full titles from the Microsoft Store. Unlock in-game extras, such as character skins or downloadable content (DLC). Renew subscriptions like Xbox Game Pass or Xbox Live Gold. This flexibility makes the codes especially appealing to players who don’t want to be locked into one option. Instead, they can decide exactly how to use their balance based on their current gaming needs. Accessibility for Players Everywhere For gamers who might not have access to a credit card or prefer not to share payment information online, Xbox gift card codes act as an accessible alternative. They can be purchased at retail stores, online marketplaces, and even gifted by friends or family. This accessibility makes gaming feel more inclusive. A teenager without access to a debit card, for example, can still buy their favorite expansion pack simply by redeeming a code received as a birthday gift. In this way, the codes break down financial and logistical barriers that might otherwise prevent players from engaging fully in the Xbox ecosystem. A Safe Way to Shop Security is always a concern when making online purchases. Gift card codes provide a sense of safety and control, since they don’t require direct banking information. Instead of worrying about unexpected charges, gamers know exactly how much they’re spending. For parents, this safety factor is especially important. Giving a child an Xbox gift card code allows them to buy games or in-game content without the risk of overspending or accidentally charging a parent’s credit card. The Social Element of Gifting Beyond personal use, Xbox gift card codes are also a way to connect socially. In the same way that movie lovers might give a streaming service subscription, gamers often exchange codes during birthdays, holidays, or special occasions. This practice goes beyond convenience—it has emotional value. A simple code can translate into hours of gaming joy, cooperative play with friends, or the excitement of finally downloading a highly anticipated release. For many, receiving an Xbox gift card is more meaningful than a generic gift because it directly ties into their favorite pastime. Expanding the Game Pass Experience One of the biggest shifts in gaming has been the rise of subscription services like Xbox Game Pass. With a rotating library of titles available for a flat monthly fee, Game Pass has become an essential part of modern gaming. Xbox gift card codes make it easy to maintain this subscription without linking a credit card. Many players use their codes to keep their Game Pass active, ensuring they always have access to new and classic titles. The connection between gift cards and subscription services adds another layer to their importance in the gaming landscape. Budget-Friendly Gaming Gaming can be an expensive hobby. Between consoles, accessories, and new releases, costs add up quickly. Gift card codes offer a way to manage spending wisely. By loading a specific amount, players can set clear limits on how much they’re willing to spend. This is especially useful during seasonal sales like Black Friday or the Xbox Summer Sale, where deals are abundant but overspending is easy. With a gift card code, a gamer might set aside $50 and challenge themselves to maximize its value by picking up multiple discounted titles. The Thrill of Digital Rewards Another reason gamers love Xbox gift card codes is the thrill of reward systems. Many platforms and loyalty programs allow players to earn points through activities such as completing surveys, participating in events, or even simply making purchases. Redeeming those points for a gift card code feels like a victory in itself. The experience mirrors the reward mechanics built into many games, creating a sense of achievement even outside the virtual world. Cultural Significance in the Gaming Community Over time, Xbox gift card codes have become more than just a financial tool—they’ve become part of gaming culture. Players often discuss them in forums, share experiences of how they used their codes, and even trade recommendations on the best games to purchase with limited credit. For younger gamers, the codes often represent independence. Receiving one allows them to make choices about their gaming experience without parental guidance. For long-time players, the codes are a convenient way to maintain a growing digital library without cluttering their shelves. Examples of How Players Use Them To better understand why these codes hold such appeal, let’s look at a few examples: The Collector – A gamer who enjoys owning as many titles as possible might use codes to gradually build up their digital collection. The Social Player – Someone who primarily plays online with friends could spend their code balance on multiplayer expansions or Xbox Live Gold. The Strategist – A player who waits for seasonal sales could stretch a single gift card across multiple discounted titles. The Casual Gamer – Someone who dips into gaming occasionally might appreciate the low-pressure option of a code instead of committing to ongoing credit card payments. The Future of Digital Gift Cards As the gaming industry continues to evolve, the role of gift card codes is likely to grow. With more digital-first releases, streaming services, and in-game economies, the demand for flexible and secure payment options will remain high. We may even see new forms of personalization, such as themed gift cards for specific franchises or collaborations with major entertainment brands. Whatever the future holds, it’s clear that these codes are not just a passing trend—they’re an integral part of the gaming experience. Conclusion Gamers love Xbox gift card codes because they offer flexibility, accessibility, safety, and social connection. They’re not just about purchasing a game; they’re about making gaming more personal, manageable, and rewarding. Whether used for subscriptions, expansions, or entire game libraries, these codes have carved out a unique place in modern gaming culture. As the digital entertainment industry grows, it’s likely that Xbox gift card codes will continue to evolve alongside it. But one thing remains certain: for gamers everywhere, these codes are a trusted gateway to unforgettable experiences.

-

Why Gamers Love Xbox Gift Card Codes The gaming community is one of the most passionate groups in the entertainment world. From blockbuster releases to indie gems, every player wants the chance to explore new titles, unlock exclusive content, and expand their gaming library. One of the most popular ways to do this is through Xbox gift card codes. While at first glance they might seem like a simple prepaid option, for many gamers they have become something more—a symbol of convenience, accessibility, and opportunity. In this article, we’ll explore why players across the globe love Xbox gift card codes, how they use them, and the cultural significance they have within gaming circles. Claim Now - Claim Now - The Flexibility of Xbox Gift Card Codes Unlike physical discs or digital purchases tied to a specific game, Xbox gift cards provide versatility. Gamers can use them to: Purchase full titles from the Microsoft Store. Unlock in-game extras, such as character skins or downloadable content (DLC). Renew subscriptions like Xbox Game Pass or Xbox Live Gold. This flexibility makes the codes especially appealing to players who don’t want to be locked into one option. Instead, they can decide exactly how to use their balance based on their current gaming needs. Accessibility for Players Everywhere For gamers who might not have access to a credit card or prefer not to share payment information online, Xbox gift card codes act as an accessible alternative. They can be purchased at retail stores, online marketplaces, and even gifted by friends or family. This accessibility makes gaming feel more inclusive. A teenager without access to a debit card, for example, can still buy their favorite expansion pack simply by redeeming a code received as a birthday gift. In this way, the codes break down financial and logistical barriers that might otherwise prevent players from engaging fully in the Xbox ecosystem. A Safe Way to Shop Security is always a concern when making online purchases. Gift card codes provide a sense of safety and control, since they don’t require direct banking information. Instead of worrying about unexpected charges, gamers know exactly how much they’re spending. For parents, this safety factor is especially important. Giving a child an Xbox gift card code allows them to buy games or in-game content without the risk of overspending or accidentally charging a parent’s credit card. The Social Element of Gifting Beyond personal use, Xbox gift card codes are also a way to connect socially. In the same way that movie lovers might give a streaming service subscription, gamers often exchange codes during birthdays, holidays, or special occasions. This practice goes beyond convenience—it has emotional value. A simple code can translate into hours of gaming joy, cooperative play with friends, or the excitement of finally downloading a highly anticipated release. For many, receiving an Xbox gift card is more meaningful than a generic gift because it directly ties into their favorite pastime. Expanding the Game Pass Experience One of the biggest shifts in gaming has been the rise of subscription services like Xbox Game Pass. With a rotating library of titles available for a flat monthly fee, Game Pass has become an essential part of modern gaming. Xbox gift card codes make it easy to maintain this subscription without linking a credit card. Many players use their codes to keep their Game Pass active, ensuring they always have access to new and classic titles. The connection between gift cards and subscription services adds another layer to their importance in the gaming landscape. Budget-Friendly Gaming Gaming can be an expensive hobby. Between consoles, accessories, and new releases, costs add up quickly. Gift card codes offer a way to manage spending wisely. By loading a specific amount, players can set clear limits on how much they’re willing to spend. This is especially useful during seasonal sales like Black Friday or the Xbox Summer Sale, where deals are abundant but overspending is easy. With a gift card code, a gamer might set aside $50 and challenge themselves to maximize its value by picking up multiple discounted titles. The Thrill of Digital Rewards Another reason gamers love Xbox gift card codes is the thrill of reward systems. Many platforms and loyalty programs allow players to earn points through activities such as completing surveys, participating in events, or even simply making purchases. Redeeming those points for a gift card code feels like a victory in itself. The experience mirrors the reward mechanics built into many games, creating a sense of achievement even outside the virtual world. Cultural Significance in the Gaming Community Over time, Xbox gift card codes have become more than just a financial tool—they’ve become part of gaming culture. Players often discuss them in forums, share experiences of how they used their codes, and even trade recommendations on the best games to purchase with limited credit. For younger gamers, the codes often represent independence. Receiving one allows them to make choices about their gaming experience without parental guidance. For long-time players, the codes are a convenient way to maintain a growing digital library without cluttering their shelves. Examples of How Players Use Them To better understand why these codes hold such appeal, let’s look at a few examples: The Collector – A gamer who enjoys owning as many titles as possible might use codes to gradually build up their digital collection. The Social Player – Someone who primarily plays online with friends could spend their code balance on multiplayer expansions or Xbox Live Gold. The Strategist – A player who waits for seasonal sales could stretch a single gift card across multiple discounted titles. The Casual Gamer – Someone who dips into gaming occasionally might appreciate the low-pressure option of a code instead of committing to ongoing credit card payments. The Future of Digital Gift Cards As the gaming industry continues to evolve, the role of gift card codes is likely to grow. With more digital-first releases, streaming services, and in-game economies, the demand for flexible and secure payment options will remain high. We may even see new forms of personalization, such as themed gift cards for specific franchises or collaborations with major entertainment brands. Whatever the future holds, it’s clear that these codes are not just a passing trend—they’re an integral part of the gaming experience. Conclusion Gamers love Xbox gift card codes because they offer flexibility, accessibility, safety, and social connection. They’re not just about purchasing a game; they’re about making gaming more personal, manageable, and rewarding. Whether used for subscriptions, expansions, or entire game libraries, these codes have carved out a unique place in modern gaming culture. As the digital entertainment industry grows, it’s likely that Xbox gift card codes will continue to evolve alongside it. But one thing remains certain: for gamers everywhere, these codes are a trusted gateway to unforgettable experiences.

-

Free TikTok Followers & Fans Profile Setup Tips 10k-1000-10000-1k (Boost Real Views, Likes) [SJPQLFT50] In the ever-evolving world of social media, TikTok has emerged as a powerhouse platform, captivating millions with its short, engaging videos. As users race to build their online presence, one question looms large: How can you gain free TikTok followers? This article delves into effective strategies to boost your TikTok audience without breaking the bank, while keeping SEO techniques in mind. CLICK HERE TO GET ACCESS ➤➤ CLICK HERE TO GET ACCESS ➤➤ Understanding the Importance of Followers on TikTok Before diving into strategies, it’s crucial to understand why followers matter. Having a solid follower count not only enhances your credibility but also increases your chances of getting featured in the "For You" page—TikTok's algorithmic showcase of popular content. More followers often lead to higher engagement rates, which can significantly impact your reach and visibility on the platform. 1. Create High-Quality Content The cornerstone of gaining free TikTok followers lies in producing compelling content. Here’s what you need to focus on: a. Authenticity Users gravitate toward authentic creators. Share your unique voice, interests, and style, as authenticity helps establish a connection with your audience. b. Trending Topics Keep an eye on current trends and challenges. By incorporating popular themes into your content, you increase your chances of being discovered by new viewers. c. High Production Quality Invest time in editing your videos. Use good lighting, crisp sound, and appealing visuals to create professional-looking content that stands out. 2. Optimize Your Profile Your TikTok profile is your online business card. An optimized profile can attract more followers. Here’s how: a. Catchy Username Choose a memorable username that reflects your brand or personality. Avoid complex spellings which can make it hard for users to find you. b. Engaging Bio Craft a bio that tells users who you are and what kind of content they can expect. Consider including keywords like "free TikTok followers" to boost discoverability. c. Profile Picture Utilize a clear and eye-catching profile picture. A friendly image or your logo can increase the likelihood of users following you. 3. Leverage Hashtags Effectively Hashtags are crucial for content visibility on TikTok. Using the right hashtags can introduce your videos to a broader audience. a. Popular Hashtags Incorporate trending hashtags relevant to your content. This not only boosts visibility but also ties your videos to current conversations. b. Niche-Specific Hashtags Don’t just rely on the popular tags; use niche-specific hashtags to connect with a targeted audience genuinely interested in your content. c. Brand Your Own Hashtag Consider creating a unique hashtag for your content, encouraging followers to engage with your videos and contribute their own takes. 4. Engage with Your Audience True engagement goes both ways. Here are ways to build relationships with your followers: a. Respond to Comments Take the time to reply to comments on your videos. Acknowledging your viewers can foster a sense of community and encourage more interactions. b. Follow Back If appropriate, follow back some of your new followers. This gesture can motivate them to remain engaged and loyal to your content. c. Use Polls and Q&A Incorporate interactive features like polls and Q&A sessions to invite direct engagement, prompting viewers to participate and share their thoughts. 5. Collaborate with Other Creators Collaboration can be a powerful tool in increasing your followers. By partnering with other TikTok users, you tap into their audience base. a. Find Your Niche Collaborate with creators who share similar interests or demographics. This ensures that the audience you reach is genuinely interested in your content. b. Cross-Promotion When you collaborate, both parties should promote the content on their profiles. This mutual endorsement can attract new followers for both creators. c. Participate in Duets Utilize the duet feature to engage with popular videos, offering your take while reaching new viewers who might be drawn to your unique style. 6. Post Consistently Consistency is key in maintaining and growing your audience. Develop a posting schedule that works for you and stick to it. a. Determine Optimal Times Identify when your audience is most active. Use TikTok's analytics tools to discover peak engagement times and plan your posts accordingly. b. Content Variety Experiment with different content types—comedy, tutorials, lifestyle, challenges, etc.—to keep your audience engaged and coming back for more. c. Set Goals Establish realistic goals for your posting frequency and follower growth. Adjust your strategy based on what works and what doesn’t. 7. Promote Your TikTok on Other Platforms Utilizing other social media platforms can drive traffic to your TikTok profile, leading to more free TikTok followers. a. Share Clips on Instagram Post short clips of your TikTok videos on Instagram Stories or Reels, encouraging your audience to follow you on TikTok for the full experience. b. Utilize YouTube Shorts Convert your TikTok videos into YouTube Shorts. This cross-promotion can expose your content to a different audience. c. Engage on Twitter Share your TikTok links on Twitter to drive traffic. Engaging with trending topics on Twitter can also attract potential followers. Conclusion: The Path to Free TikTok Followers Building a follower base on TikTok requires a blend of creativity, strategy, and authenticity. By focusing on high-quality content, optimizing your profile, effectively using hashtags, engaging with your audience, collaborating with creators, posting consistently, and promoting your TikTok on other platforms, you can significantly increase your chances of gaining free TikTok followers. Remember, the key to long-term success on TikTok is patience and authenticity. Stay true to your style, keep experimenting with content, and watch your follower count grow organically over time. With consistency and dedication, you’ll make your mark in the vibrant world of TikTok.

-

wuxiong2 joined the community

-

CarloUSA joined the community

-

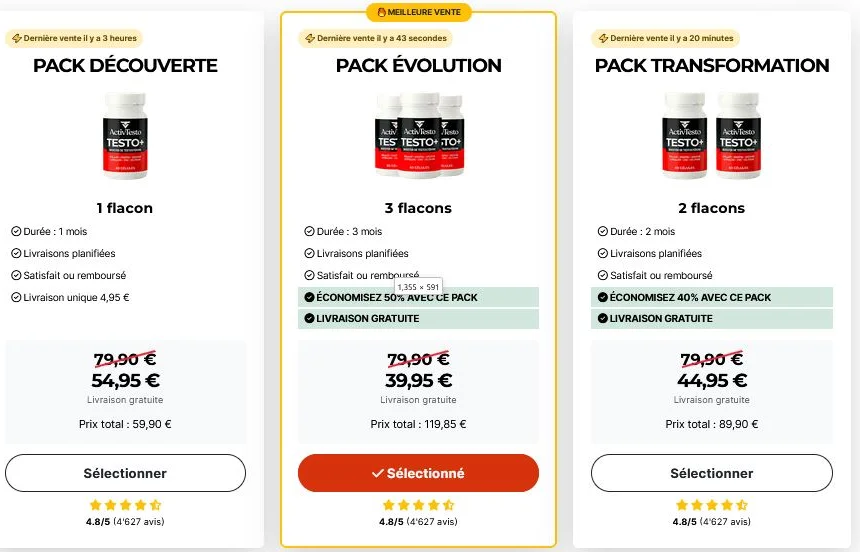

Avis complet sur ActivTesto Testo+ – Capsules Testo Plus ActivTesto Plus Avantages, parfois appelé Testo Plus, est un complément alimentaire destiné aux hommes souhaitant retrouver une vitalité sexuelle, plus d’énergie, une libido renforcée et une endurance prolongée. Ce type de supplément est conçu pour soutenir naturellement le métabolisme masculin et améliorer les performances intimes et physiques. ➥ Visitez le site officiel et commandez au meilleur prix ! Ce que prétend ActivTesto Testo+ Selon ses fabricants, ActivTesto Offre+ combine plusieurs ingrédients soigneusement sélectionnés pour : ✔ Stimuler l’énergie et réduire la fatigue ✔ Améliorer la libido naturelle ✔ Renforcer l’endurance physique et sexuelle ✔ Soutenir l’équilibre hormonal masculin La formule comprend des composants reconnus pour leurs effets sur la vitalité masculine comme : Shilajit, Ginseng, L‑arginine, L‑citrulline, zinc et sélénium — qui jouent un rôle essentiel dans le fonctionnement hormonal, la circulation sanguine et la sensation de vigueur. Avis des utilisateurs Les retours des utilisateurs sont l’un des indicateurs importants pour mesurer l’efficacité d’un complément comme ActivTesto Plus Prix. On observe généralement : Retours positifs fréquents Beaucoup rapportent plus d’énergie dans la journée Certains signalent une amélioration de l’endurance lors d’efforts physiques et intimes Plusieurs commentaires parlent d’une libido plus active Dans l’ensemble, les avis utilisateurs observés en ligne donnent souvent des notes élevées, avec des retours généralement positifs sur la vitalité et la performance. Points à considérer Comme pour tout complément, les résultats peuvent varier selon l’âge, le métabolisme et l’état de santé Certains utilisateurs n’observent qu’un effet léger ou temporaire Il est important d’utiliser le produit régulièrement et sur plusieurs semaines pour évaluer les résultats Composition — Ce qu’il y a à l’intérieur La formule ActivTesto Plus Ingrédients contient des ingrédients étudiés scientifiquement pour leurs bénéfices potentiels : Shilajit – Pierre minérale ayurvédique associée à l’énergie et à l’endurance Ginseng – Connu pour ses propriétés adaptogènes et stimulantes L‑Arginine & L‑Citrulline – Acides aminés favorisant une meilleure circulation Zinc & Sélénium – Minéraux essentiels au bon équilibre hormonal masculin Cette combinaison vise à travailler à la fois sur l’endurance physique et sexuelle, ainsi que sur la vitalité globale. ➥ Visitez le site officiel et commandez au meilleur prix ! Prix – Combien coûtent les capsules Testo Plus ? Le ActivTesto pour améliorer la virilité varie selon le vendeur et le conditionnement, mais voici une idée générale : En ligne, certains produits similaires appelés “Testo Plus” sont vendus autour de environ £29,95 (~35 €) pour un flacon standard. Des versions premium ou grands formats peuvent coûter plus cher, notamment autour de €39,99 ou plus selon les ingrédients. En pharmacie locale en France ou en Inde, ce produit spécifique (ActivTesto Testo+) n’est pas toujours référencé, et le prix dépendra de la disponibilité. Souvent, ces compléments sont vendus davantage en ligne que dans les pharmacies physiques. Où acheter ActivTesto Testo+ ? En ligne Souvent disponible sur le ActivTesto Effets Secondaires du produit Marchés internationaux ou plateformes spécialisées Livraison mondiale directe Acheter en ligne permet souvent de bénéficier de offres spéciales, promotions ou garanties de remboursement. En pharmacie / magasins physiques Actuellement, ces capsules ne sont pas toujours disponibles dans toutes les chaînes de pharmacie classiques. Si vous ne les trouvez pas : Vous pouvez demander aux pharmaciens s’ils peuvent commander un complément similaire, ou rechercher des alternatives qui soutiennent le métabolisme masculin (voir exemples ci‑dessous). Exemples de suppléments similaires (pour comparaison) Voici quelques produits liés que l’on peut ActivTesto Site officiel en Inde ou en ligne pour la vitalité masculine : Compléments populaires Testo+ 120 Caps – Complément très bien noté (4.8★) pour énergie et performance Kapiva Testo Capsules – Option naturelle pour énergie et vitalité Testo Pro+ Capsules / Testo pro + capsule – Alternatives abordables Testo Booster Advanced Tablet – Soutien énergie et performance Viasta Testo Power Capsules – Booster ayurvédique pour endurance Ces produits proposent des formules similaires axées sur l’énergie masculine, la testostérone naturelle, la libido ou l’endurance physique. Conseils d’utilisation Pour obtenir les meilleurs résultats avec des capsules comme ActivTesto Expérience : Suivez la posologie recommandée quotidiennement. Adoptez une alimentation équilibrée et active. Assurez‑vous d’avoir un sommeil suffisant et régulier. Hydratez‑vous bien pour optimiser les effets des ingrédients. Consultez un professionnel de santé si vous avez des conditions médicales ou prenez d’autres médicaments. ➥ Visitez le site officiel et commandez au meilleur prix ! Conclusion Qu'est-ce que ActivTesto/ Testo Plus Capsules est présenté comme un complément alimentaire conçu pour : soutenir l’énergie améliorer l’endurance sexuelle stimuler naturellement la libido renforcer la vitalité masculine Sa formule combine des ingrédients reconnus et bénéficie de nombreux avis positifs en ligne, même si les résultats peuvent varier selon chaque individu. En matière de prix, ce type de produit se retrouve surtout en ligne, avec des offres variables selon le vendeur. L’achat direct sur le site officiel ou chez des revendeurs fiables reste le moyen le plus simple de s’en procurer. Pinterest: https://in.pinterest.com/pin/1094515515709282956 https://in.pinterest.com/pin/1094515515709282998 https://in.pinterest.com/pin/1094515515709284812 https://in.pinterest.com/pin/1094515515709284778 Videos: https://www.youtube.com/watch?v=rG3sK2Yqh9s https://www.dailymotion.com/video/xa0u5x4 https://vimeo.com/1168816934 Allez-y aussi: https://www.kissnutra.com/da/evitrol-anmeldelser/ https://www.kissnutra.com/pl/nutrilaben-recenzje/

-

ActivTesto Testo Plus –Testo Plus : Avis détaillé et guide complet ActivTesto Testo Plus est un complément alimentaire conçu pour les hommes qui souhaitent améliorer leur vitalité, stimuler leur libido, augmenter leur endurance et soutenir leur énergie globale. La vie moderne, avec son stress, son rythme soutenu et ses responsabilités multiples, peut souvent entraîner une baisse de la vitalité, un manque de motivation et des troubles de la performance sexuelle. ActivTesto Testo Plus a été développé pour répondre à ces besoins, en combinant des ingrédients naturels et scientifiquement étudiés, ciblant à la fois l’énergie, la performance physique et la santé intime. ➥ Visitez le site officiel et commandez au meilleur prix ! Une approche globale de la vitalité masculine La conception d’ActivTesto Testo+ Avis Testo Plus repose sur une approche holistique visant à améliorer plusieurs aspects de la santé masculine : Énergie quotidienne et réduction de la fatigue : Les ingrédients énergisants permettent de soutenir le métabolisme et d’augmenter la vitalité. Endurance physique et sexuelle : Le produit aide à prolonger les efforts physiques et les performances intimes. Libido et désir : La formule favorise le maintien d’un désir naturel et soutenu, grâce à des nutriments qui stimulent les fonctions hormonales et la circulation sanguine. Équilibre hormonal : Des minéraux essentiels soutiennent la production et la régulation hormonale, un facteur crucial pour la santé masculine. Bien-être général : Une énergie retrouvée et une libido stimulée améliorent la confiance en soi, l’humeur et la qualité de vie quotidienne. Cette approche globale fait d’ActivTesto Testo Plus un produit adapté à un usage régulier, avec des effets progressifs et durables sur la santé physique et intime. Composition et ingrédients clés La force ActivTesto Gélules Testo Plus réside dans sa formulation, qui combine plusieurs ingrédients naturels reconnus pour leurs propriétés stimulantes et revitalisantes : Shilajit : Minéral naturel utilisé dans la médecine traditionnelle pour ses propriétés énergisantes et adaptogènes. Il aide à améliorer la résistance physique et à soutenir la vitalité. Ginseng : Plante adaptogène qui augmente l’endurance, réduit le stress et favorise la performance globale. L-Arginine et L-Citrulline : Acides aminés essentiels qui stimulent la circulation sanguine, contribuant à une meilleure performance physique et sexuelle. Zinc et Sélénium : Minéraux clés pour le maintien de l’équilibre hormonal et la santé reproductive masculine. La combinaison de ces composants vise à soutenir l’énergie, l’endurance et la libido de manière naturelle et progressive, tout en contribuant au bien-être général de l’homme. Les principaux bénéfices d’ActivTesto Testo Plus Augmentation de l’énergie et de la vitalité : Les ingrédients revitalisants réduisent la fatigue et permettent de se sentir plus actif tout au long de la journée. Endurance améliorée : La capacité à maintenir la performance physique et sexuelle est optimisée, permettant de prolonger les efforts et les moments de plaisir. Libido et désir stimulés : Le complément aide à retrouver un désir sexuel plus fort et une réactivité accrue, contribuant à une expérience intime plus satisfaisante. Confiance en soi renforcée : L’énergie et la vitalité retrouvées influencent positivement l’état d’esprit, la motivation et la confiance dans la vie quotidienne. Soutien hormonal naturel : Les minéraux et acides aminés présents dans la formule favorisent l’équilibre hormonal et la santé reproductive. Ces bénéfices expliquent pourquoi de nombreux hommes choisissent ActivTesto Gélules Testo Plus pour soutenir leur vitalité et prolonger la satisfaction dans leur vie intime. ➥ Visitez le site officiel et commandez au meilleur prix ! Témoignages et avis utilisateurs Les retours d’expérience sont essentiels pour évaluer l’efficacité réelle d’un produit. Les utilisateurs ActivTesto Testo Plus Testo Plus rapportent régulièrement : Une augmentation de l’énergie et de la motivation dès les premières semaines d’utilisation. Une endurance améliorée, tant dans les activités physiques que dans les rapports intimes. Une libido plus active, avec un désir accru et une réactivité améliorée. Une confiance en soi retrouvée, ce qui améliore la qualité de vie et des relations personnelles. Une satisfaction globale accrue, tant sur le plan physique qu’émotionnel. Certains utilisateurs soulignent que les effets peuvent varier selon l’âge, le métabolisme et l’état de santé initial, mais la majorité constate une amélioration notable avec un usage régulier. Conseils pour une utilisation optimale Pour tirer le meilleur parti ActivTesto Plus Avis : Respecter la posologie recommandée sur l’emballage. Adopter une alimentation équilibrée, riche en nutriments essentiels pour la vitalité. Pratiquer une activité physique régulière, qui renforce l’endurance et le tonus musculaire. Veiller à un sommeil de qualité, indispensable pour la récupération physique et mentale. Maintenir une bonne hydratation, qui optimise l’absorption des nutriments et l’efficacité des ingrédients. L’utilisation régulière et la combinaison avec un mode de vie sain permettent de maximiser les effets du complément sur l’énergie, la performance et le bien-être général. Prix et disponibilité Le prix des capsules ActivTesto Plus en pharmacie varie selon le nombre de capsules par flacon et les promotions disponibles. Le produit est généralement plus facilement accessible sur les plateformes de vente en ligne spécialisées dans les compléments alimentaires. En pharmacie, la disponibilité peut varier selon le pays et la chaîne de distribution. L’achat en ligne permet souvent de bénéficier de réductions et de packs économiques. Pourquoi choisir ActivTesto Testo Plus ? Formule complète et naturelle adaptée aux besoins multiples de l’homme moderne. Soutien physique et hormonal, pour une efficacité globale sur la vitalité et la performance. Effets sur l’énergie, l’endurance et la libido, confirmés par les retours utilisateurs. Facilité d’utilisation, avec des capsules pratiques à intégrer à la routine quotidienne. Effets progressifs et durables, offrant un soutien fiable sur le long terme. ActivTesto Testo Plus et le bien-être masculin L’énergie et la performance sexuelle ne se limitent pas à la sphère intime. Elles influencent également la motivation, la concentration, la productivité et la confiance dans la vie professionnelle et personnelle. En améliorant ces aspects, ActivTesto Plus Acheter Plus participe à une meilleure qualité de vie globale, permettant aux hommes de se sentir plus engagés, plus actifs et plus satisfaits de leur quotidien. ➥ Visitez le site officiel et commandez au meilleur prix ! Conclusion ActivTesto Amélioration Masculine est un complément alimentaire complet conçu pour soutenir la vitalité masculine sous plusieurs aspects : énergie, endurance, libido et équilibre hormonal. Sa formulation naturelle, combinée à des ingrédients scientifiquement sélectionnés, en fait une solution fiable pour les hommes souhaitant améliorer leur performance physique et sexuelle. Les témoignages positifs des utilisateurs confirment l’efficacité progressive du produit, notamment lorsqu’il est associé à un mode de vie sain et équilibré. En adoptant ActivTesto Testo Plus dans votre routine quotidienne, vous pouvez retrouver énergie, confiance et satisfaction dans votre vie intime et votre quotidien. C’est un choix adapté pour tout homme souhaitant prolonger le plaisir et améliorer sa vitalité de manière naturelle et durable. Pinterest: https://in.pinterest.com/pin/1094515515709282956 https://in.pinterest.com/pin/1094515515709282998 https://in.pinterest.com/pin/1094515515709284812 https://in.pinterest.com/pin/1094515515709284778 Videos: https://www.youtube.com/watch?v=rG3sK2Yqh9s https://www.dailymotion.com/video/xa0u5x4 https://vimeo.com/1168816934 Allez-y aussi: https://www.kissnutra.com/da/evitrol-anmeldelser/ https://www.kissnutra.com/pl/nutrilaben-recenzje/

-

activtesto joined the community

-

In a world where daily demands rarely slow down, maintaining consistent wellness can feel like a challenge. Long work hours, environmental stressors, processed foods, irregular sleep, and digital overload all place strain on the body’s natural systems. Over time, even small imbalances in hydration, nutrient intake, or recovery can lead to fatigue, weakened immunity, and reduced mental clarity. AquaThrive LX Daily Wellness was developed to provide well-rounded nutritional support designed to strengthen the body’s core foundations—hydration, energy production, immune resilience, and cellular protection. Rather than targeting only one aspect of health, this formula embraces a comprehensive approach. By supporting the body at a cellular level, Aquathrive LX Daily Wellness aims to help individuals maintain steady vitality and balance in their everyday lives. https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjPxZmfPwmcDwbse_NKahlsvQoNoIISG_Y6s-2cnKIbPPADEi0gdHdhUU85wol34tPiRgJx2NB1GdcyBHOcmuW1HwRZxxJfm5cW5kV9useAV-0MRomKGOYNjmVe7-x8i0Js47iZ9L1ua8pICia3OaDutXJne_d1FcdrtZqKoFhDyAXCSDJfIFRiyWGseT7_/w640-h434/fgg.png Order Now – Limited Time Offer The Foundation: Cellular Health and Nutrient Efficiency Every system in the human body depends on healthy cells. From the heart and brain to muscles and skin, cellular function determines how efficiently the body performs and repairs itself. When cells are properly nourished and hydrated, they can carry out metabolic processes more effectively, producing energy and maintaining structural integrity. Aquathrive LX Digestion Support focuses on optimizing nutrient delivery and cellular absorption. It incorporates highly bioavailable ingredients that are easier for the body to absorb and utilize. This ensures that essential vitamins, minerals, and supportive compounds are not wasted but actively contribute to wellness processes. When cellular health improves, individuals may notice: Increased stamina Better recovery after activity Enhanced focus Balanced mood Greater physical resilience The supplement’s goal is to provide steady internal support rather than temporary stimulation. Intelligent Hydration Beyond Water Hydration plays a crucial role in nearly every physiological process. It supports temperature regulation, joint lubrication, circulation, and nutrient transport. However, drinking water alone does not guarantee optimal hydration. Electrolytes help regulate how fluids move into and out of cells, influencing muscle function, nerve signaling, and cognitive performance. AquaThrive LX incorporates hydration-supportive minerals designed to maintain electrolyte balance. This can be particularly helpful for individuals who exercise regularly, live in warm climates, or consume beverages like coffee that may influence fluid balance. Proper hydration support may contribute to: Reduced muscle fatigue Improved endurance Enhanced mental clarity Stable energy levels When cells are adequately hydrated, they perform more efficiently, supporting overall vitality. Sustainable Energy Production Many people rely on caffeine or sugary products for quick bursts of energy. While these can provide temporary stimulation, they often result in energy crashes. Aquathrive LX Discount takes a more sustainable approach by supporting mitochondrial health—the mechanism by which cells convert nutrients into usable energy. Through its blend of essential micronutrients, the supplement encourages efficient metabolic pathways. By assisting in the breakdown of carbohydrates, fats, and proteins, it promotes consistent energy release throughout the day. This balanced support may help: Reduce mid-day sluggishness Improve physical stamina Support post-exercise recovery Enhance productivity Instead of pushing the body into overdrive, AquaThrive LX helps it operate at its natural optimal rhythm. https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiooOWegSxWB6cHRCdJKaaOvrgUIonAhF03g8CO_CJNcLasXEYX4mb8OdX0GLaSpQ1VWq2k8aIs6t7mfHVYhbT2ipYC2bJVGQPpmyFARHiBbeJJ_827USMhJOgiwmEsoVVXxje40YmX-mtL2LDuHxB4Ov7_If7596kr66tWnEfrnoTPjk3UsUyth1ZrFACO/w446-h640/hdh.png Official site exclusive offer. Free shipping on orders now! Immune System Reinforcement The immune system works continuously to defend the body against external challenges. Proper nutrition is essential for maintaining immune cell production and communication. Deficiencies in key vitamins and minerals can compromise immune responsiveness. AquaThrive LX Daily Wellness integrates immune-supportive nutrients alongside antioxidant compounds. Antioxidants help neutralize free radicals—unstable molecules generated by stress, pollution, and metabolic activity. By lowering oxidative stress, the immune system can function more effectively. Consistent immune support may: Strengthen natural defense mechanisms Promote faster recovery Enhance overall resilience Provide support during seasonal changes Balanced immunity contributes not only to protection but also to long-term vitality. Antioxidant Defense and Detox Support Daily exposure to environmental pollutants, processed foods, and psychological stress can increase oxidative burden. Over time, oxidative stress may contribute to cellular wear and visible signs of aging. Aquathrive LX Near Me includes antioxidant-supporting ingredients that assist the body’s natural detoxification systems. The liver and kidneys continuously filter waste products, and adequate nutrient support helps these organs function efficiently. By promoting antioxidant balance, the supplement may contribute to: Healthier-looking skin Reduced signs of fatigue Enhanced post-activity recovery Support for healthy aging This proactive approach reinforces the body’s ability to maintain internal balance. Cognitive Function and Mental Clarity Mental sharpness is essential in both professional and personal life. Concentration, memory retention, and emotional stability are influenced by nutrient availability and hydration levels. AquaThrive LX contains nutrients associated with neurological health and oxygen transport. By supporting proper circulation and cellular hydration, the formula may enhance cognitive clarity. Users may experience: Improved concentration Reduced brain fog Better stress adaptation Balanced mood support Consistent mental clarity helps individuals stay productive and engaged throughout the day. Digestive Harmony and Nutrient Utilization Digestion is the gateway to nutrient absorption. Even the highest-quality ingredients cannot provide benefits if the digestive system is not functioning efficiently. Aquathrive LX Supplement is designed to complement digestive processes, supporting enzyme activity and gut balance. When digestion operates smoothly, the body can better absorb essential nutrients, supporting energy, immunity, and hormonal balance. Digestive support may lead to: Improved comfort after meals Enhanced nutrient uptake Increased overall vitality Greater consistency in wellness A healthy digestive system serves as the foundation for total-body support. Adaptable for Diverse Lifestyles One of the strengths of AquaThrive LX Daily Wellness is its versatility. It is suitable for adults seeking proactive health support, whether they are managing demanding careers, maintaining fitness routines, or focusing on long-term wellness goals. It can be particularly beneficial for: Busy professionals Students balancing academic pressures Fitness enthusiasts Frequent travelers Individuals seeking preventative care Its balanced composition allows it to integrate seamlessly into a variety of daily routines. Quality and Manufacturing Standards Quality is critical when choosing a wellness supplement. Aquathrive LX Energy & Vitality is formulated with carefully selected ingredients that prioritize purity and bioavailability. Manufacturing processes emphasize consistency and safety, ensuring that each serving meets established quality benchmarks. By focusing on effective ingredient combinations and responsible production practices, the formula aims to deliver reliable daily support. Building a Sustainable Wellness Routine While AquaThrive LX Daily Wellness provides valuable nutritional support, it is most effective when combined with healthy habits. A balanced diet rich in whole foods, consistent hydration, regular physical activity, adequate sleep, and stress management all contribute to long-term health. Taking the supplement daily as directed encourages steady progress rather than short-term results. Over time, consistent support may enhance resilience, balance, and overall vitality. Conclusion Aquathrive LX Order offers a comprehensive approach to supporting hydration, energy production, immune defense, antioxidant protection, and cognitive clarity. By focusing on cellular efficiency and nutrient optimization, it strengthens the body’s foundational systems. In a fast-moving world where wellness can easily be compromised, having a reliable daily supplement can make a meaningful difference. AquaThrive LX is designed not as a quick fix, but as a steady partner in building long-term health, resilience, and sustainable performance. Visit Also https://www.offerplox.com/men-health/sensselo-male-enhancement-review/

-

aquathrivelx joined the community

-

anjanamilan joined the community

-

Planning for retirement requires clear understanding of 401(k) investments, withdrawal rules, hardship eligibility, and support options. In this comprehensive guide, we explain in detail how a Fidelity Investments 401(k) works, how withdrawals are processed, available investment choices, hardship withdrawal requirements, terms and conditions, and official support channels. We present accurate, structured, and practical information designed to help participants make informed financial decisions. What Is a Fidelity 401(k) Withdrawal and How Does It Work? A Fidelity 401(k) withdrawal refers to removing funds from your employer-sponsored retirement account administered by Fidelity. Withdrawals are governed by IRS regulations, employer plan rules, tax policies, and distribution eligibility criteria. Types of Fidelity 401(k) Withdrawals 1. Standard Retirement Withdrawal Participants can withdraw funds penalty-free after age 59½. Withdrawals are treated as taxable income unless the account contains Roth 401(k) contributions that meet qualified distribution requirements. 2. Early Withdrawal If funds are withdrawn before age 59½, a 10% early withdrawal penalty typically applies in addition to ordinary income taxes. Certain IRS exceptions may eliminate the penalty, including: · Permanent disability · Qualified domestic relations orders (QDRO) · Certain medical expenses · Separation from service at age 55 or older (if permitted by the plan) 3. Required Minimum Distributions (RMDs) At age 73 (subject to current IRS rules), participants must begin taking Required Minimum Distributions unless still actively employed under qualifying plan provisions. 4. Rollover Withdrawals Participants leaving an employer may roll over funds into: · A new employer’s 401(k) · A traditional IRA · A Roth IRA (tax implications apply) A direct rollover avoids immediate taxation. Fidelity Investments 401(k) Withdrawal Options Explained Withdrawal options depend on your plan structure. Fidelity typically allows: · Lump-Sum Distributions · Partial Withdrawals · Installment Payments · Annuity Distribution Options (if plan-supported) Each option carries distinct tax treatment, withholding requirements, and processing timelines. Most distributions are processed within 5–10 business days, depending on verification and banking details. Participants can request withdrawals through: · Online account portal · Workplace NetBenefits platform · Phone-based representative assistance · Required forms submission (for certain hardship or complex cases) Fidelity 401(k) Withdrawal Terms and Conditions (PDF Overview) Each employer-sponsored plan administered by Fidelity Investments has unique governing documents. These include: · Summary Plan Description (SPD) · Distribution policies · Hardship qualification documentation requirements · Loan policies · Vesting schedules · Rollover eligibility terms The official plan documents, typically available in PDF format via the participant portal, outline: · Tax withholding percentages · Mandatory 20% federal withholding for eligible rollover distributions · Processing fees (if applicable) · Blackout periods · Spousal consent requirements (for certain plans) Reviewing the official PDF documentation ensures compliance with your employer’s specific rules before initiating a withdrawal. Fidelity Investments Hardship Withdrawal: Eligibility and Requirements A hardship withdrawal allows access to funds due to immediate and heavy financial need. However, strict documentation is required. Common Hardship Qualifying Reasons · Medical expenses for participant, spouse, or dependents · Purchase of primary residence · Tuition and educational fees · Prevention of eviction or foreclosure · Funeral expenses · Certain home repair costs after casualty damage Important Hardship Rules · Only employee contributions may be eligible (varies by plan) · Earnings may or may not be included · Withdrawals are generally taxable · Early withdrawal penalty may apply if under 59½ · Repayment is not permitted (unlike loans) Hardship withdrawals require: · Supporting financial documentation · Signed certifications · Review and approval by plan administrator Processing times depend on verification completeness. What Is a Fidelity 401(k) Investment and How Does It Work? A Fidelity 401(k) investment refers to allocating contributions into various investment options available within your retirement plan. Contribution Structure Employees contribute a portion of salary pre-tax or Roth (after-tax). Employers may offer: · Matching contributions · Profit-sharing contributions · Safe Harbor contributions Contributions are invested based on participant-selected allocations. Types of Fidelity 401(k) Investment Options A Fidelity 401(k) typically offers diversified investment categories: 1. Target-Date Funds Professionally managed portfolios that automatically adjust risk based on retirement year. 2. Mutual Funds Actively managed or index funds covering: · U.S. equities · International equities · Bonds · Balanced funds 3. Index Funds Low-cost funds tracking market indexes such as: · S&P 500 · Total Market Index · International Indexes 4. Stable Value Funds Lower-risk options designed for capital preservation. 5. Company Stock (If Offered) Some plans allow investment in employer stock. Participants can adjust allocations online and rebalance periodically. Fidelity 401(k) Investment Management and Strategy Effective 401(k) investment management includes: · Asset allocation planning · Risk tolerance assessment · Diversification strategy · Periodic rebalancing · Fee evaluation Participants can use online planning tools or consult licensed representatives for portfolio guidance. Many plans provide: · Retirement calculators · Investment comparison tools · Educational webinars · Personalized investment advice (additional fees may apply) Fidelity 401(k) Withdrawal Phone Number and Support Options For withdrawal-related inquiries, participants may contact Fidelity Investments through: Primary Support Channels · Workplace Investing Customer Service: 1-(855) 477-3548 (U.S.) · Online secure messaging · NetBenefits platform · Automated phone system · Virtual assistant chat International participants should check region-specific contact numbers available through their account portal. Customer service representatives assist with: · Distribution eligibility confirmation · Tax withholding elections · Hardship documentation guidance · Rollover coordination · Account verification Fidelity 401(k) Investment Phone Number and Support Options Investment-related assistance is also available through the same Workplace Investing support line. Representatives provide help with: · Asset allocation guidance · Fund prospectus access · Contribution changes · Beneficiary updates · Rollover investment selection Participants may also schedule: · Retirement planning consultations · Virtual advisor meetings · In-person branch appointments (where available) Support is generally available Monday through Friday during extended business hours, with automated services available 24/7. Tax Implications of Fidelity 401(k) Withdrawals Understanding taxation is essential before initiating a withdrawal. Traditional 401(k) · Contributions are pre-tax · Withdrawals taxed as ordinary income Roth 401(k) · Contributions are after-tax · Qualified withdrawals are tax-free Mandatory federal withholding typically applies to eligible rollover distributions unless directly rolled over. State tax withholding depends on residency. Consulting a tax professional ensures accurate reporting and compliance. Processing Time and Direct Deposit Setup Withdrawal speed depends on: · Banking verification · Type of distribution · Plan approval requirements · Documentation completeness Most direct deposits are processed within 5–7 business days. Paper checks may take longer. Participants should ensure: · Bank information is accurate · Address details are updated · Required documents are uploaded promptly Key Considerations before Taking a Fidelity 401(k) Withdrawal Before initiating a distribution, evaluate: · Long-term retirement impact · Penalty exposure · Tax bracket implications · Alternative financing options · Loan availability (if plan allows) Preserving retirement savings supports long-term financial stability. Conclusion: A Fidelity 401(k) withdrawal involves structured regulations, tax implications, and employer-specific terms. A Fidelity 401(k) investment offers diversified retirement growth opportunities through professionally managed funds, index strategies, and customizable asset allocation. Related post: https://www.linkedin.com/pulse/guide-fidelity-phone-number-401k-contact-investment-support-verma-fzkyc/ https://www.linkedin.com/pulse/fidelity-phone-number-1855-477-3548-how-contact-support-shreen-vogue-johhc https://www.linkedin.com/pulse/fidelity-investments-withdrawal-1855-477-3548-customer-shreen-vogue-pxmzc https://www.linkedin.com/pulse/fidelity-401k-withdrawal-1855-477-3548-guide-rules-terms-shreen-vogue-vwxrc https://www.linkedin.com/pulse/what-fidelity-investments-1855-477-3548-phone-number-customer-vogue-rrsac https://www.linkedin.com/pulse/fidelity-401k-loans-vs-withdrawals-1855-477-3548-which-shreen-vogue-plkvc https://www.linkedin.com/pulse/fidelity-401k-withdrawal-guide-rules-terms-1855-477-3548-shreen-vogue-l8jgc https://www.linkedin.com/pulse/how-withdraw-1-855-477-3548-money-from-fidelity-401k-ashok-khati-gebic https://www.linkedin.com/pulse/how-1855-477-3548-add-money-fidelity-account-shreen-vogue-0yvac https://www.linkedin.com/pulse/how-1855-477-3548-withdraw-money-from-fidelity-401k-shreen-vogue-uodyc https://www.linkedin.com/pulse/how-do-i-1855-477-3548-withdraw-money-from-fidelity-guide-vogue-ppzec https://www.linkedin.com/pulse/how-withdraw-money-from-fidelity-401k-complete-guide-shreen-vogue-v9buc https://www.linkedin.com/pulse/fidelity-401k-customer-service-1-855-477-3548-phone-number-vogue-p9syc https://www.linkedin.com/pulse/fidelity-401k-contact-1-855-477-3548-phone-number-speak-shreen-vogue-xr7fc https://www.linkedin.com/pulse/fidelity-help-number-1-855-477-3548-how-contact-customer-shreen-vogue-fluec https://www.linkedin.com/pulse/complete-guide-1-855-477-3548-fidelity-phone-numbers-customer-vogue-mtytc https://www.linkedin.com/pulse/how-withdraw-money-from-1-855-477-3548-fidelity-401k-before-vogue-s37uc https://www.linkedin.com/pulse/how-withdraw-money-from-1-855-477-3548-fidelity-401k-shreen-vogue-lbnuc https://www.linkedin.com/pulse/how-withdraw-money-from-1-855-477-3548-fidelity-401k-without-vogue-nirac https://www.linkedin.com/pulse/how-withdraw-from-1-855-477-3548-fidelity-401k-after-leaving-vogue-mq6qc

-